Indirect labor costs are the wages paid to different manufacturing facility employees concerned in manufacturing. Costs of payroll taxes and fringe benefits are usually included in labor prices, but could additionally be treated as overhead prices. Labor prices could also be allocated to an item or set of items based on timekeeping information. The Weighted Common technique averages the cost of all stock objects obtainable for sale through the interval, smoothing out value fluctuations.

As demonstrated in the price of sales example above, understanding what goes into your product or service helps you figure out the profitability of buyer purchases. The cost of sales figure is a baseline – you know you should cost above this to make a revenue. This is often a debit to the purchases account and a credit score to the accounts payable account. At the top of the reporting interval, the steadiness within the purchases account is shifted over to the stock account with a debit to the inventory account and a credit to the purchases account. Finally, the resulting e-book stability in the stock account is in comparability with the precise ending stock amount.

Accounting Software

When it involves cost of sales vs. expenses, performing and analyzing each calculations may help you make good financial selections for your business. We break down the parts that make up COS and show you the means to calculate price of gross sales. The cost of sales is the amassed total of all costs used to create a services or products, which has been sold. The price of gross sales is a key a part of the performance metrics of an organization, since it measures the ability of an entity to design, supply, and manufacture items at an affordable price. The applicability of common price extends to forecasting, providing a lens to predict future financial developments. Average price data from historic intervals is extrapolated to envision financial eventualities.

Value-based Pricing

Since the gas is saved in giant tanks, figuring out the worth of the petrol bought at any given time can be impractical with different stock valuation strategies. Additionally, the common price technique aids in smoothing out price fluctuations. Companies dealing in industries where prices change incessantly, such as commodities, could discover this significantly useful. By averaging out the prices https://www.kelleysbookkeeping.com/, spikes in costs won’t drastically affect the valuation of stock. To illustrate, imagine an organization with one hundred units of a product for sale.

The 7-step Sales Process: A Guide To Closing Extra Deals

Understanding the interplay between common price, competition, provide and demand, and production effectivity supplies invaluable perspective in the dialogue of market economies. Speaking about manufacturing effectivity, when the typical price is minimized, the agency is alleged to be producing at its most efficient scale, balancing the prices of production with the quantity of output. As a outcome, reaching the lowest common price is the primary goal of a agency in search of effectivity in production. In conclusion, average price is a reliable ally in budgeting and forecasting. It brings quantifiable clarity into planning, controlling costs, sizing up financial requirements, and danger management while contributing to agile decision-making. The higher the accuracy of these common cost calculations, the extra robustly financial plans may be constructed and business visions achieved.

Moreover, average value forecasting simplifies the estimation of sales revenue. By multiplying the forecasted models to be sold by their common value, companies can anticipate gross profit, contemplating sales costs remain constant. The average value of producing every unit of products or service can considerably impression an organization’s profit margins. This is as a outcome of the typical value is immediately subtracted from the agency’s gross sales revenue to determine its revenue margin. In the realm of provide chain administration, average cost plays a main position in defining the efficiency average cost of sales and profitability of operations.

- The connection between these prices and the average value is crucial for strategic price management.

- For businesses, cost of sales (COS) is a crucial financial metric as it provides detailed information into varied aspects of the operations.

- The value of sales (or typically price of good sold) is deducted from a company’s income to reach at the company’s gross profit.

- Both the Old UK generally accepted accounting rules (GAAP) and the present Monetary Reporting Commonplace (FRS) require COGS for Revenue Tax submitting for most companies.

- In short, value of gross sales is an important financial efficiency metric, as it tracks your capability to manufacture/deliver items and providers at an affordable cost.

- As demonstrated in the price of sales example above, understanding what goes into your services or products helps you figure out the profitability of customer purchases.

You’ll need to know the stock cost methodology that your corporation or accountant is utilizing. In this article, we’ll have a extra in-depth have a look at these costs and show you the way to perform the value of sales calculations alongside numerous other metrics. In the top, understanding these elements helps you keep your business operating smoothly without burning via money on unnecessary bills. So, if you can stop paying for something and still make your product, it’s probably not part of the value of gross sales. We will also embrace examples that can help you understand the method of calculating the price of items offered. Having a greater view of your inventory is considered one of the most necessary factors that affect your bottom line.

Many companies use software to streamline monitoring and reduce discrepancies that could impression monetary statements. Learn to accurately calculate the price of sales by understanding its parts, inventory techniques, and valuation methods for higher financial insights. If you may be importing uncooked supplies or components to be used within the product, then you can even add transport and freight fees to the total price.

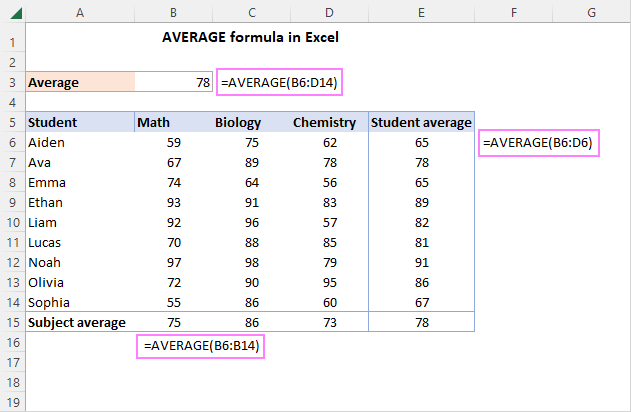

In our example, the inventories purchased experienced a worth appreciation. January buy prices per unit have been $130, February purchase prices per unit had been $150, and March buy costs per unit had been $200. Therefore, because the periodic system uses the costs of goods out there on the market over the complete quarter, more is allocated to the prices of goods bought for the sale of stock. In a periodic stock system, the company does an ending stock count and applies product costs to discover out the ending inventory price. COGS can then be decided by combining the ending inventory cost, starting inventory price, and the purchases throughout the period.